Investment Options

When you decide to set up an ABLE account, one size doesn’t fit all. That’s why we’ve proposed several investment options to help you find the one that best fits your needs.

Choosing Cash Verses Investment

The Cash Option

The Cash Option deposits 100% of its funds into an FDIC-insured account with The Bank of New York Mellon (the “Bank”). FDIC insurance generally protects up to $250,000 of your deposits at the same bank in the same ownership right and capacity. Your ABLE Account invested in the FDIC Savings Fund, will be insured up to $250,000.

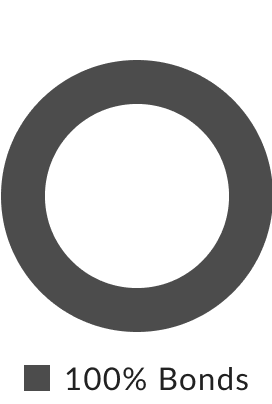

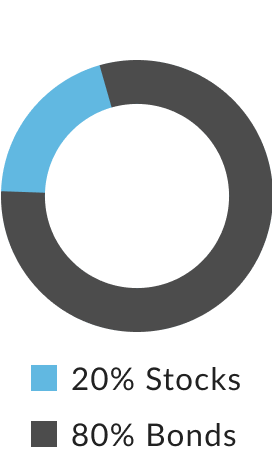

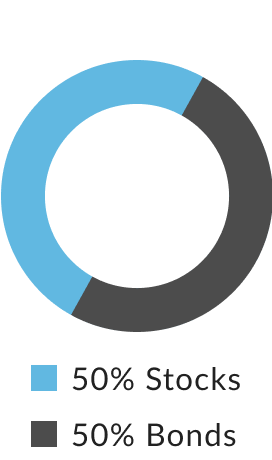

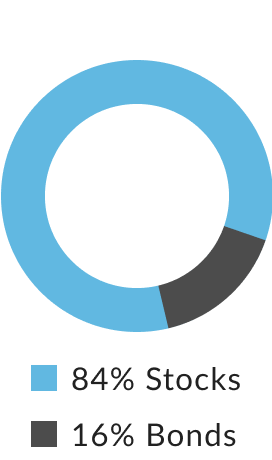

Investment Portfolio Options

You may also choose one of four investment portfolios with different investment strategies: ABLE Fixed Income, ABLE Conservative, ABLE Moderate, or ABLE Aggressive. Each investment option has its own benefits and risks — compare them below:

Combined Cash and Investment Options

You can choose to invest in the Cash Option or a combination of the Cash Option and Investment Option(s). Whichever option(s) you choose, be sure to review the Program Disclosure Booklet for specific risks and be sure to check with an investment professional if you need advice.

Fees

There’s a low annual fee of $35 for each Maryland ABLE account to keep everything running smoothly. There are also asset-based fees on the underlying mutual funds, which are a part of each of the investment options, and an administrative fee assessed on the overall account assets. These add up to between 0.30% and 0.38% of the account’s balance per year. Additional fees are added when you opt out of electronic statements or request a withdrawal check, instead of doing everything online. You can check them out in our Program Disclosure Booklet.